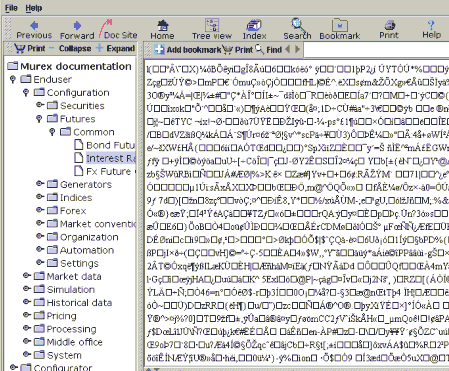

Murex Mx3 User Manual

- 19 Comments!

Choose business IT software and services with confidence. Read verified MX.3 Platform Trading Platforms System Software Reviews from the IT community.

Murex’s collateral management product MX.3 offers functionality across a broad product range covering bilateral legal agreements, OTC clearing and listed derivatives. Core functions include end-to-end margin management and integrated settlement and accounting, portfolio reconciliation, dispute management and collateral inventory management. Features MX.3 features automated trade processing workflow and integration with affirmation and execution platforms. Madness project nexus mod download. Central clearing of OTC derivatives trades is supported with margin processing of broker and Central Counterparty (CCP) statement with native multi-currency and multi-margin capabilities, as well as monitoring of CCP clearing limits. Risk can be controlled with eligibility and concentration rules and margin computation functionality. The service offers support for both internal and external repo and securities lending deals to effect collateral transformation. Additionally, MX.3 features an enterprise collateral inventory management system.

Reporting functionality includes an array of tools enabling user to slice-and-dice collateral data as required. Transaction lifecycle support Murex’s platform supports the complete derivatives transaction lifecycle from “cradle-to-grave”. It covers valuation, confirmation, settlement and accounting.

Onboarding Murex offers clients dedicated client support teams that offer highly personalised support. Implementation is supported by a customer delivery services business division focused on offering professional services for specialist project tasks, managing the network of implementation partner relationships and managing MXpress, which combines pre-packaged MX.3 content with an accompanying standardised implementation methodology.

Contents • • • • History [ ] In 2013, undertook an overhaul of its trading operations by going live on MX.3 to support its FX trading and processing. MX.3 was first adopted in and subsequently rolled out to its international operations on a phased basis. In 2014 the Singaporean-based bank,, adopted MX.3 in its operations. UBS announced that it had chosen Murex’s software to replace a large part of its platform technology, including the booking of, valuation and risk management.

Shillingburg fundamentals of fixed prosthodontics pdf free download full. This was considered to be a significant technology shift by a large lender at the time, driven by the need to cut costs and replace a patchwork of systems with a standardised solution. In the Truffle 100 rankings for 2016, Murex became the third largest with an announced turnover of 460 million euros. It employs around 2,200 employees worldwide, including 800 in Paris. [ ] Murex partnered with Tullet Prebon, allowing them to use TPI data for internal model validation. China Merchants Bank (CMB) went live on Murex’s MX.3 trading platform to improve the technology at its and operations, following the bank becoming one of the first Chinese financial institutions to join the R3 consortium.

Murex took part in the pilot project for Teen Turn in Dublin, an initiative that is seeking to create a talent pipeline for women in (STEM). Murex announced its partnership with Microsoft, bringing MX.3 into the cloud with certification on Microsoft Azure. Salim Edde, one of the founders of the company, is referenced in the. ATB Financial began the first phase of moving its infrastructure and application management into the cloud with the implementation of Murex’s MX.3 Software-as-a-Service (SaaS) solution [ ] in August 2017.